Worldwide IT Spending to Grow 5.5% in 2023 as Digital Transformation Continues

Spending on devices will decline while cloud infrastructure will see significant growth, analysts say

- By Kristal Kuykendall

- 04/07/23

Worldwide IT spending is expected to increase 5.5% this year to a total of $4.6 trillion by the close of 2023, according to the latest forecast by Gartner. The market research firm also predicts that continued economic disruptions will not impact the push for digital transformation.

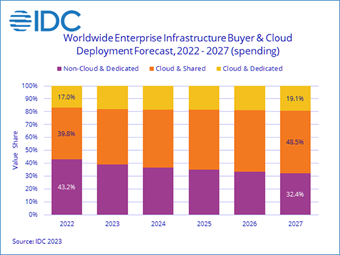

One of the areas in IT spending expected to see the most growth in spending is cloud infrastructure, according to International Data Corp.’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment. IDC said in the new report that it expects to see continuous strong demand for shared cloud infrastructure, which will surpass non-cloud infrastructure in spending this year for the first time.

Spending on devices is projected to decline in 2023, as is spending on non-cloud infrastructure, IDC’s report said.

“Macroeconomic headwinds are not slowing digital transformation,” said John-David Lovelock, Research Vice President and analyst at Gartner. “IT spending will remain strong, even as many countries are projected to have near-flat gross domestic product growth and high inflation in 2023. Prioritization will be critical as CIOs look to optimize spend while using digital technology to transform the company’s value proposition, revenue and client interactions.”

Gartner’s report predicted that the software segment will see double-digit growth this year as enterprises prioritize spending to capture competitive advantages through increased productivity, automation and other software-driven transformation initiatives. Conversely, spending on devices will decline nearly 5% in 2023, Gartner said, as consumers defer device purchases due to declining purchasing power and a lack of incentive to buy.

IDC’s new report focuses on compute and storage cloud infrastructure spending, spending on compute and storage infrastructure products for cloud deployments, including dedicated and shared IT environments; IDC is forecasting such spending to grow 6.9% this year over 2022, reaching $93.7 billion by year’s end. The total spending projection represents a significant decrease from last year’s 19.4% annual growth, reflecting IDC’s “expectation that the market will face significant macroeconomic headwinds and curbed demand, with cloud staying positive due to the drive for modernization, opex focus, and continued growth in digital consumer services demand, while non-cloud spending contracts as enterprise customers shift towards capital preservation.”

IDC projects that non-cloud infrastructure spending will decline 10.3% to $59.8 billion in 2023. Spending on shared cloud infrastructure is expected to grow 7.5% year over year to $66.1 billion for the full year, while spending on dedicated cloud infrastructure is expected to grow 5.4% to $27.6 billion in 2023.

IDC projects that non-cloud infrastructure spending will decline 10.3% to $59.8 billion in 2023. Spending on shared cloud infrastructure is expected to grow 7.5% year over year to $66.1 billion for the full year, while spending on dedicated cloud infrastructure is expected to grow 5.4% to $27.6 billion in 2023.

Spending on cloud infrastructure continues to outgrow the non-cloud segment although the latter had strong growth in 4Q22 as well, increasing 9.4% year over year to $18.7 billion. The market “continues to benefit from high demand, large backlogs, rising prices, and an improving infrastructure supply chain,” IDC said. For the full year in 2022, spending on shared cloud infrastructure totaled $61.5 billion, growing 20.1% year over year. The dedicated cloud infrastructure segment grew 18.0% in 2022 to $26.2 billion.